Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation. Ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore. Read on

Abstract

By the end of this decade, the mission for critical power equipment will dramatically change. Why? Because growing electricity demand combined with insufficient generating capacity will cause frequent power interruptions—and skyrocketing costs for electricity. How will this impact requirements for stationary batteries? Likely developments include frequent—even daily—cycling, stacking of new applications, and bi-directional charging synchronized with grid operations. Many experts are skeptical that the mission for critical power equipment could shift so soon. Yet this paper makes the case that megatrends are already creating a “perfect storm” for the U.S. electric grid. A maelstrom of grid disruptions and rolling blackouts will become the new normal for facility operators. Suppliers who adapt quickly will prosper, but slow movers will be left sitting on the sidelines.

Don’t have time to read the whitepaper?

Get the slide deck Bill presented at Acme Conference and dive into the data behind the report.

Introduction

The critical power industry is nearing the largest and most significant inflection point in its history. Megatrends of artificial intelligence (AI), hyperscale data centers, and electrification on a massive scale are coalescing to create a perfect storm for grid operators, electricity consumers, and equipment suppliers. Three factors drive this intensifying maelstrom:

- Huge increments of new electric load. Added load will come from data centers, newly constructed factories, electric vehicle chargers, heat pumps, and other electrification.

- Mass retirement of dispatchable generation capacity. Intermittent resources such as wind and solar will not reliably substitute for this lost capacity.

- Increased failures of aged grid equipment. Running old assets in start-stop mode will dramatically accelerate failures. This is especially true for coal-fired plants which still provide 17% of America’s electricity.

This perfect storm is one hundred percent certain because it is already forming. In just a few years, energy emergencies and rolling blackouts will become more frequent, longer, and in more locations, than at any time since the inception of America’s interconnected grid. The cost of electricity will swing wildly—during periods of scarcity, prices will catapult to staggering heights; at other times, excess power from subsidized renewables will cause negative prices.

A peek into the future: August 2030

Rolling blackouts due to inadequate power generation and transmission capacity have become a regular occurrence. Regions most affected include Washington DC/Northern Virginia, New York/New Jersey, coastal California, and Texas.

Critical shortages of capacity, such as those seen in Texas during the 2021 Winter Storm Uri, are causing dangerous dips in grid frequency. Repeated experiences during under-frequency events have honed grid operators’ skills at avoiding total system collapse. Catastrophic damage to core grid components has been largely avoided, but aging distribution transformers regularly explode and catch fire.

The replacement lead time for these transformers is now two years. Leadtime for 400-ton generator step-up transformers is more than three years—these transformers are necessary to connect new generating plants and build new high voltage transmission lines. Meanwhile factories making gas turbine generators are at maximum capacity. With an order backlog of five years.

Even in regions that have avoided blackouts so far, gensets and uninterruptible power system (UPS) equipment run dozens of times each year. Most utilities require hyperscale data centers to have interruptible power contracts—their load is the first to be shed when electricity supplies run short. After all, data centers don’t vote, and their complaints have little weight with state Public Utility Commissions (PUCs).

Faced with a doubling of large loads from 2025 to 2030, grid operators regularly dispatch on-site power generated at data centers. Asset owners initially protested but ultimately complied with state legislation requiring dispatch in exchange for grid interconnection. In late 2025, Texas became the first state to require large loads (data centers and industrial sites) to make their backup generators available to grid operators for dispatch during energy emergencies. A majority of states have followed the lead of Texas. ERCOT, the grid operator for Texas, “wrote the book” on how to dispatch data center power. Its operational procedures served as the model for a mandatory reliability standard set by the North American Electric Reliability Corporation (NERC).

Electricity markets serve two-thirds of the U.S. population: California, Texas, New York, New England, the mid-Atlantic region, and most of the Midwest. For consumers in these regions, a shortage of dispatchable capacity has caused massive inflation in wholesale electricity prices. While regulator-mandated price caps aren’t much higher than those in 2025 (then $5,000 per megawatt hour in ERCOT, or 111 times the average 2021 price), wholesale prices approach caps regularly. Frequent operation at price caps has caused average rates for commercial and industrial (C&I) customers to escalate nearly fourfold. Even outside electricity markets, in so-called “cost-of-service” regions, state PUCs are imposing double-digit rate increases.

Across the U.S., major utilities face bankruptcy and are forced to rely on federal loan guarantees. The state PUCs tried to protect ratepayers but have now relented, allowing utilities to pass on losses incurred during massive price spikes. Time-of-use pricing for C&I customers is now extreme, swinging wildly between negative—when customers are paid to consume excess renewable generation—and astronomical peaks.

In response to billions of dollars in inflated electricity bills,[1] companies across the country have been forced to reexamine how they operate mission-critical systems. The prospect of cost savings from discharging normally idle standby batteries during high tariff hours and recharging them during periods of negative pricing has caught the attention of even non-technical chief financial officers (CFOs). Every battery, from purpose-built battery energy storage systems (BESS) to standby batteries, has been drafted into service. Standby batteries now are expected to be discharged dozens—or even hundreds—of times each winter and summer. Savvy asset owners now get positive cash flows from selling energy stored in batteries back to their utilities during high time-of-use periods.[2]

When the finance people wanted to stack this profit mission for stationary batteries atop the standby power mission, reaction was predictable. Power professionals at data centers and telecom facilities raged, practically in unison, “are you NUTS?! You’ll have to pry standby battery capacity out of my cold, dead hands!” Ultimately, the finance people prevailed.

Traditional battery systems, unidirectional UPS, and unidirectional chargers have proven unsuited for this new environment. Most standby batteries were designed for long-term float use, not daily cycling. Many of these older-style batteries have since been replaced.

Disruption of the power electronics industry was more significant. Large numbers of UPS and critical power battery chargers needed replacement, as few were capable of operating bidirectionally to export battery energy to the grid.

Battery capacity has expanded significantly to enable the safe stacking of the time-shifting application atop the fundamental standby power mission. The demand for power conversion capacity has been even more extreme. In addition to needing to charge bigger batteries, customers now need to recharge batteries quickly. Periods of negative electricity prices are often unpredictable. Accepted battery charging practice is to charge as hard and fast as the battery allows to take maximum advantage of being paid to consume electric power.

Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Although significant, the capital cost of bigger batteries and higher capacity power electronics are trivial compared to potential cost savings. Avoiding high time-of-use charges drives cost savings. Leveraging periods of negative pricing is another opportunity for these, as well.

The bulk of these changes for the mission-critical power industry began in 2026 and are still being implemented in 2030. The past four years have manifested the most significant disruption in the history of this typically slow-moving industry.

While this hypothetical 2030 scenario may seem extreme, it is by no means improbable. Although extreme scenarios for human-built systems are rare, they do occur, much like hurricanes, earthquakes, and tsunamis occur in nature. The value in considering extreme scenarios is that they open eyes to possibilities that the daily grind obscures. The facts underpinning this 2030 scenario are megatrends and electric grid circumstances that are real, ongoing, and increasingly not in dispute.

“Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.”

- Lorem Ipsum

New requirements for critical power equipment

Stepping again into 2030, let’s survey the landscape of facilities and equipment, to see what is selling. While it’s too risky to predict specific technologies or suppliers, it seems reasonable to predict general requirements:

Energy storage requirements

- Minimum life of 5,000 cycles, 20-year calendar life to support expected 200 days/year full discharge/recharge cycle.

- “Materially larger” batteries (five to ten times or more the capacity of today’s standby batteries) to support stacking the time-shifting mission atop the existing critical mission application.

- Full compliance with relevant domestic and global safety standards. This will be table stakes.

- Exceedingly low risk of fire, approaching that of legacy lead-acid and NiCd technology. This need will be driven by customers wanting to install storage inside their facilities, rather than in outdoor containers.

Power conversion requirements

- Full bi-directional capability, UL listed to 1741 and similar standards for grid-interactive operation and ability to quickly reverse

- Capability for centralized control, e.g., from either an on-site source or on-command from a virtual power plant operator or other grid source.

- Much higher power than today’s power electronics. Example: Assume that a battery charger rated at 10 kW is used for a given standby battery today. Now assume that the future battery is five times this capacity, and that the user wishes to charge that higher capacity battery in just four hours instead of 24. Assume charging efficiency similar to today’s batteries, charging a battery five times bigger in one-sixth the time requires 30 times the power. The former 10 kW charger is replaced by a 300 kW unit.

- DC voltage higher than 125 or 250 volts is necessary to minimize the cost of conductors, circuit protectors, and other current-limited components. Eight hundred volts nominal could become typical for many mid-size battery banks.

Other requirements

- Higher power AC feeders to the site will be needed to move more power into and out of the new larger power electronics.

- DC-DC conversion will be needed to convert high DC bus voltages down to legacy voltages of 250, 125, 48 volts, etc.

- Updates to training and personal protective equipment to work around the more hazardous, higher DC voltages and higher energies.

Facts about the “perfect storm” facing the electric grid

For decades, electricity service in the U.S. has been generally reliable. But in the near future, rapid load growth, retirement of dispatchable generation, and increased failures of aged grid equipment will cause frequent capacity shortages. When operating reserves run low, grid operators will impose rolling blackouts.

Rolling blackouts will be concentrated in areas with high load growth, large losses of dispatchable generation, and unwillingness to invest in energy infrastructure. For example, New York State has declined the option to build gas pipelines from the Marcellus shale formation to generating plants. New York has also mandated the electrification of cooking equipment and vehicle fleets. These environmental initiatives will increase electricity demand.

California and Texas are wild cards for different reasons. Texas’ rapid population and economic growth will continue to strain all its resources, including electric power. Although California’s population is shrinking, the state’s sizeable economy depends heavily on electric power imported from other areas. Should this power become unavailable, California’s situation will be more dire than other states.

Rapid load growth

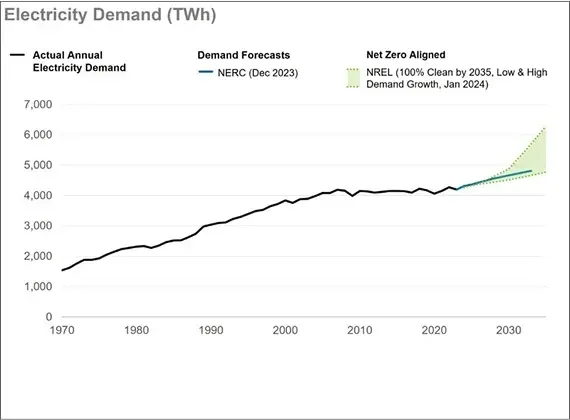

Figure 1. U.S. Actual and Forecasted Electricity Demand – 1970-2023

The first driver of the grid’s perfect storm will be significant growth in electrical loads caused by AI data centers, population increase, return of domestic manufacturing, electric vehicle chargers, heat pumps, and other electrification. Average load growth in the United States has been nearly flat for 10 years, growing just 0.3% annually from 2013 to 2023. It is now expanding rapidly. In 2024, NERC estimated load growth surged to nearly 2%. The National Electrical Manufacturers Association (NEMA) estimates that U.S. power demand will increase more than 50% over the next 25 years.[3]

Peak demand—a weather-driven phenomenon—is also increasing. Heat waves and cold snaps cause peak demand, but only for a small proportion of the hours in each year. According to Grid Strategies, the projection for peak demand growth in early 2024 was 67 GW. Later in the same year, however, their estimate nearly doubled to 128 GW—5% annually. [4] By any measure, these load growth estimates are massive.

Rapid load growth

In 2015, the U.S. electric grid had 1,080 gigawatts of dispatchable generation capacity. Five years later, 8% had been lost, reducing capacity to 1,000 gigawatts. Approximately 177 gigawatts were retired, including 109 gigawatts of coal-fired capacity, 51 gigawatts of gas-fired, 10 gigawatts of oil-fired plants, and 7 gigawatts of nuclear. New construction of 97 gigawatts could not fill the gap—in the past ten years, the US retired twice as much dispatchable capacity as was commissioned.[5]

More dispatchable generation is the answer—but it will not arrive soon enough. Only four gigawatts of dispatchable generation were commissioned in 2024. One of those gigawatts came from Vogtle Unit 4, a reactor at the only nuclear plant constructed in decades. On a sustainable basis, the U.S. really added about three gigawatts in 2024.[6]

Figure 1. U.S. Actual and Forecasted Electricity Demand – 1970-2023

Solar and wind power cannot substitute for dispatchable generation. Although the U.S. added 200 gigawatts “nameplate capacity”[7] of solar and wind from 2015 to 2025, the average output of these resources is only 21% and 33% of nameplate, respectively. When this nameplate capacity is adjusted for actual output, only 55 gigawatts remain.[8] Moreover, solar and wind are intermittent resources. Snow cover is a surprisingly effective barrier to photovoltaic (PV) operation. The Germans refer to unfavorable renewable conditions as “Dunkelflaute,” meaning “dark doldrums.” During such conditions, the amount of installed renewable capacity is meaningless; there’s no electrical output at all. Proponents say offshore wind is more reliable, but its construction is expensive and slow. Moreover, the Trump Administration began revoking offshore wind permits in April 2025.

What about new transmission capacity?

Most electricity in the U.S. is consumed in metro areas on the East and West Coasts, but wind turbines work best in the middle of the continent, where the wind is strongest. Plenty of people are in favor of massive, high-voltage transmission lines to transport wind power from flyover country to power-hungry, coastal consumers.

However, three significant impediments exist to this solution: 1) legal challenges, 2) NIMBY opponents, which together have nearly halted construction of new interstate transmission lines, and 3) extremely long lead times to acquire their key components. The third is most significant, because it cannot be resolved by court orders or legislation. Large power transformers at transmission substations are 400-ton behemoths that are not built in the United States and have lead times of three years or more. Additionally, during the past five years, the price of such transformers has increased by 40%; tariffs will only exacerbate inflating prices.

What about batteries?

The viability of high-capacity batteries, such as those in BESS, depends on the application. When BESS are installed on customer premises, they can have significant reserve capacity compared to facility load. Accordingly, BESS can materially improve the economics of facility power in areas with high time-of-use tariffs or high demand charges. However, in utility-scale configurations with solar and wind generation (“hybrid systems”), BESS capacity is typically limited to four hours or less of discharge; therefore, renewables plus batteries cannot substitute for dispatchable generation. So, while BESS can alleviate electricity shortages at peak hours, these batteries are too costly to solve the more general problem of providing backup power during days-long wind and solar droughts over wide areas.

Consider Minnesota as an example. According to 2024 EIA data, Minnesota’s average daily electrical consumption is 179 gigawatt-hours (GWh). Let’s assume in a hypothetical future that 50% of Minnesota’s electric power is generated by either wind or solar. Let’s also assume a three-day wind drought, heavy cloud cover, and prior snowfall on solar farms —output from these renewables would be zero. The battery capacity needed to supply Minnesota’s needs for three days would thus be 179 GWh/day *50% renewable share *3 days, or 269 GWh. This energy of 269 GWh is three times the entire installed BESS capacity of 88 GWh[9] in the entire United States at the end of 2024.

According to 2024 EIA data, Minnesota consumes approximately 1.65% of total United States electricity generation. Although this is an oversimplification, extrapolating Minnesota’s three-day need for backup to the entire United States results in required battery capacity of 16,000 GWh. This number far exceeds available financing and manufacturing capacity. It means that the role of BESS will remain limited—much like the role of batteries in a hybrid vehicle on a cross-continental trip.

What about nuclear power?

Nuclear power looks like a solution, and should be a solution, but won’t be a solution in the short term. The U.S. has 94 operating nuclear reactors generating about 20% of total demand. Twenty-one commercial power reactors are undergoing decommissioning but only three of these are candidates for restart: Palisades Nuclear Plant, Three Mile Island Unit 1, and Duane Arnold Energy Center.

Large nuclear plants of conventional design require more than a decade to build. In fact, it took 15 years to permit and build Vogtle Units 3 and 4, the last United States nuclear reactors commissioned. These units cost twice as much to build as originally budgeted.

While new nuclear technologies such as small modular reactors (SMR) are being developed, their timeline is also long. The only U.S. Nuclear Regulatory Commission (NRC)-approved design for SMR, NuScale’s VOYGR, started its formal design process in 2007.

Other SMR companies are entering the race. Most of them are betting on a new type of nuclear fuel called high assay, low-enriched uranium (HALEU), versus the low-enriched uranium used by all current U.S. nuclear plants and NuScale. The combination of new reactor designs and new fuel type makes it possible that their NRC certifications will take even longer and cost much more than NuScale endured. Thus, the prospect of widespread SMR adoption in the next 5 or even 10 years is remote.

Are gas turbines the answer to lost dispatchable generation?

Of the dispatchable generating plants currently in interconnection queues, nearly all are gas-fired. However, this new capacity also faces impediments: limits on opposition from environmental groups, slow permitting, and long lead times for construction —natural gas power plants typically take four years for permitting and another four years to build. New gas-fired plants cannot be built without sufficient pipeline capacity. Unfortunately, the interstate gas transmission system has little slack capacity. Court challenges by environmental groups and NIMBYs have halted construction of new pipelines. The U.S. Congress had to pass special legislation to overcome court challenges impeding completion of the last major pipeline, the Mountain Valley Pipeline.

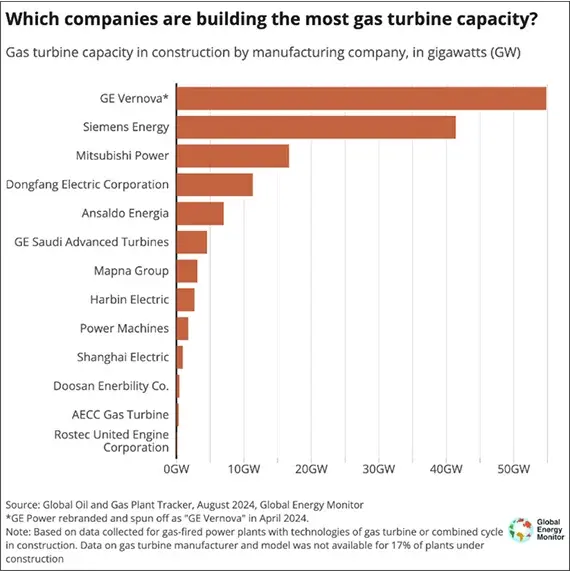

According to the industry newsletter CTVC, manufacturing constraints will also hamper new plant construction:

Gas turbine manufacturers are swamped with orders, with delivery backlogs that stretch past 2029 already leading to project cancellations, like Engie pulling out of two gas plant projects in Texas late last month. As these delays pile up, the risk of gridlock grows — threatening to short-circuit load growth and power down grid reliability. [10]

Another source, Heatmap, says rather than pushing for massive expansion, manufacturers have begun to limit investments to protect high equipment margins. They fear overexposure if the expected growth of data center demand fails to come to fruition.[11]

What about nuclear power?

Increased failures of aged grid equipment

Will delaying retirement of dispatchable generating plants, especially coal-fired plants, save the day? Not so fast. Plant owners are increasingly declaring forced outages during energy emergencies. Steam turbine generators in these facilities were designed for constant base-load operation. The grid in 2025, however, includes enough renewable generation to force large thermal plants to run intermittently.

For decades, coal plants delivered highly dependable, low-cost power. In April 2025, the Trump administration signed an Executive Order to keep coal plants open, but this lifeline fails to address two fundamental problems. First, deferred maintenance costs to refurbish coal-fired plants would be monumental. Why do more than minimal maintenance on an asset that has effectively been banned? Second, start-stop operation causes thermal cycling for which plant boilers were not designed. Twenty years’ worth of stress can be accumulated in a fraction of that time.

Thermal stress amplifies the risk of boiler explosions, like the one that killed three workers at the Salem Harbor Power Station in 2007, although the Salem Harbor boiler was inspected annually. This boiler was 50 years old, which also approximates the average age of grid assets in 2025.

Most coal plant operators have reacted to two decades of societal antagonism quite logically—they have chosen to run these assets into the ground. As a result, a growing number of experts estimate that most U.S. coal-fired generation (today 17% of supply) will be retired by 2030.

Are there grounds for optimism?

Absolutely …there are grounds for optimism! A potential source of dispatchable generation sits fully fueled and mostly idle. It is standby power at C&I enterprises. The combined capacity of C&I standby generators installed in the United States is between 130 and 200 gigawatts[12], with about 45 gigawatts of that capacity located at hyperscale data centers.

This installed base of standby generators could replace retiring dispatchable generation much faster than building new generating plants and transmission lines for their interconnection. If generator installations and data centers continue to expand, which they will, this capacity could provide reserve power during peak usage periods, negating much of the need for new plants. Minimal upgrades to distribution systems would be required. One hundred gigawatts of standby generators would add about 10% dispatchable capacity to the U.S. electric grid—enough for 3-5 years of load growth. Unfortunately, this proposal faces three obstacles:

First — U.S. Environmental Protection Agency (EPA) regulations for standby generators. Most standby generators are reciprocating internal combustion engines (RICE), either diesel or gas powered. The EPA has imposed successive rounds of emission regulations, the most recent requiring so-called Tier 4 controls. Nearly all standby generators have Tier 2 or lower controls, therefore, limiting their operation to “emergencies”—i.e., when rolling blackouts are imposed. A modification to the EPA regulation would be necessary for standby generators to provide grid power.[13]

Second — generator transfer switches and controls. Few generators today include equipment to enable seamless operation in parallel with the grid. These would need to be retrofitted at considerable cost and effort. This, however, is a small fraction of the required permitting time required for new natural gas or nuclear power plants, or gas pipelines to be built.

Third — resistance of power utilities to enable and facilitate on-site power operating in concert with the grid. This obstacle is arguably the most difficult to solve.

Despite these impediments, leveraging standby generators could be the quickest way to bolster grid stability—and it could be financially beneficial for C&I enterprises. This would avoid many of the problems with building large, centralized generating plants: long waits for grid interconnection, supply chain issues for gas turbines and power transformers, and legal challenges before Public Utility Commissions and the Federal Energy Regulatory Commission. And importantly, using these existing resources could be the cheapest solution for electricity ratepayers of all categories, including residential consumers.

Are there examples of data centers helping the grid?

Data centers commonly reserve critical power equipment exclusively for their own use. However, in the future regulators are likely to require data centers to generate power as a precondition for obtaining electricity service. In Texas, Senate Bill 6 would require data center owners to provide their own day-to-day electricity and also make it available for emergency dispatch. In New Hampshire, data centers not connected to the local electric grid—and having their own generation—would avoid burdensome permitting.

The Institute of Electronical and Electronic Engineers (IEEE) provides ongoing coverage of distributed power generation concepts. This quote from a 2023 issue of their Electrification Magazine article describes evolving practice in northern Virginia, location of the world’s largest concentration of data centers:

With growing frequency, utilities and grid operators are calling on data centers to run their generators preemptively to balance loads and prevent grid outages. These requests can add days or weeks to the annual runtime of the generators, significantly increasing both their emissions and cost to operate. In Virginia, USA, the state Department of Environmental Quality (DEQ) has proposed suspending certain requirements to allow data center operators in the state to run their generators for extended periods of time and avert disruptions from overtaxed transmission infrastructure. In a public notice soliciting comment on the plan, the agency wrote, ‘data center operation relies on the use of large amounts of electricity from the grid. DEQ is concerned that the counties of Fairfax, Loudoun and Prince William is an area in which there may not be sufficient amount of electricity for data centers due to severe, localized constraints in electricity transmission.[14]

Conclusion

By the end of this decade, electricity shortages and blackouts will become more frequent, longer, and more widespread than at any time since the inception of the U.S. electric grid. During scarcity, the price of electricity will reach staggering heights. At other times, businesses will be paid to consume. As grid disruptions and volatile prices affect bottom lines, many C&I enterprises will add or repurpose stationary batteries.

For users and manufacturers of critical power equipment—especially batteries and their power electronics—operational practices and designs will need to change. Batteries that can reliably and frequently cycle will replace batteries that sit idle 99% of the time. High power, bi-directional power electronics that fully synchronize with the grid will replace today’s single-function chargers and UPS. And there will be other developments that we may not anticipate now but that will be essential, nonetheless.

While this will be a challenging time for America, suppliers of critical power equipment will see increased opportunities. Conventional designs will be replaced by more capable products. New suppliers will arise from within and from outside the industry. Legacy suppliers will need to adapt if they don’t want to be left sitting on the sidelines.

For us, the old ways of thinking are facing unprecedented challenges. As an industry, we will need to adapt or make way for those who do.

Lorem Ipsum is simply dummy text

Lorem Ipsum is simply dummy text of the printing and typesetting industry.“Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Sources

[1] The EIA estimated total spend in 2024 by United States C&I customers for electric power at $268 billion. Quadrupling the cost of electric power thus represents a deadweight loss of $804 billion to the U.S. C&I economy. Paying four times as much for the same amount of electric power is a textbook example of “stagflation.”

[2] “Industry analysts” estimate the total installed capacity for on-premises batteries in the U.S. (excluding utility-scale BESS), is in the range of several gigawatt hours, with some estimates suggesting 10 GWh in 2024. The 2030 estimate is nearly three times this size, or 30 GWh. The potential value of this stored energy is considerable: We assume that the average price in 2030 that utilities pay during peak time of use (TOU) periods will be $10/kWh. We will assume that one-third of this capacity, or 10 GWh, is discharged 200 days/year and recharged at an average of zero dollars (because of negative pricing). The result is $20 billion/year in positive cash flow from standby batteries that are used to shift the time of electric power consumption. This analysis ignores revenue from consuming power during negative price periods because the duration and timing of these periods is so variable. The safe assumption now is to assume zero cost of electric power to recharge.

[3] A Reliable Grid for an Electric Future: NEMA’s Grid Reliability Study, NEMA, April 2025

[4] John D. Wilson, Zach Zimmerman, and Rob Gramlich. “Strategic Industries Surging: Driving US Power Demand.” GridStrategies. December 2024. Available online at: https://gridstrategiesllc.com/wp-content/uploads/National-Load-Growth-Report-2024.pdf

[5] Source: Mini-keynote address of Thomas Popik to Electric Generating Systems Association conference. April 8, 2025. Charlotte, North Carolina.

[6] Ibid.

[7] “Nameplate capacity” is the maximum design capacity of electrical equipment, which may be less than the capacity in actual operation.

[8] Ibid.

[9]Estimate of 88 GWh is based on 76,103 MWh of large-scale BESS and 11,492 MWh of small-scale BESS capacity at the end of 2024. Estimates for 2024 use reported EIA data for 2023 and assume a 66% annual growth rate for 2024 installations, in line with the prior year growth. Three hours duration for small-scale BESS is assumed. U.S. EIA. “Battery Storage in the United States: An Update on Market Trends.” April 25, 2025.

[10] Gas Turbine Gridlock #236, CTVC, March 10, 2025

[11] The Natural Gas Turbine Crisis, Heatmap, February 26, 2025

[12] Source: Foundation for Resilient Societies presentation to EGSA conference, April 2025

[13] Foundation for Resilient Societies has filed a Petition for Rulemaking to the EPA to allow 500 hours of annual operation for emergency generators. The petition is available online at the foundation’s website, www.resilientsocieties.org

[14] Evolving a Data Center into a Microgrid: Industry Perspectives and Lessons Learned, IEEE Electrification Magazine, September 2023